TOPIC ON MY MIND: Financial literacy - how important is it?

More than a third of Australians are financially illiterate...

Pondering

I recently caught up with the founder of Mandy Money as she was after some general, founder-to-founder advice.

Not only did I thoroughly enjoy our conversation, but I was left wanting to explore a big question:

tl;dr

It turns out, financial illiteracy is a BIG, global problem, and it appears to disproportionately impact females, younger people, less educated people, and people in ethnic minorities.

For example, in Australia, recent research findings from the University of Newcastle show us some sobering statistics… here are some:

“just 66 per cent of Australians can be classed as financially literate”;

“43% of young people aged 18 to 24 years reported that they could not meet their personal debt obligations”; and

“individuals with higher financial wellbeing experience significantly higher levels of general life satisfaction”.

There’s a lot more I want to learn about this, including the following, but I’ll need to come back to this in due course:

what are the root causes of financial illiteracy?

does the general population even “see” the problem, and/or can the general population identify as financial illiterate/literate?

are people motivated to become financially literate?

what is the best way to improve financial literacy? (education? on-the-job training? etc)

what is the impact of both financial literacy and illiteracy on the broader economy?

A quick investigation…

A quick search reminds me of the significant rise in scams we, as a society, are battling, and an endless number of investment horror stories…

But, this isn’t too helpful, nor is it scratching my itch to learn more. I want to understand this problem at a more granular level, i.e. by applying first principles thinking. This is a great description of first principles thinking:

I think people’s thinking process is too bound by convention or analogy to prior experiences. It’s rare that people try to think of something on a first principles basis. They’ll say, “We’ll do that because it’s always been done that way.” Or they’ll not do it because “Well, nobody’s ever done that, so it must not be good. But that’s just a ridiculous way to think. You have to build up the reasoning from the ground up—“from the first principles” is the phrase that’s used in physics. You look at the fundamentals and construct your reasoning from that, and then you see if you have a conclusion that works or doesn’t work, and it may or may not be different from what people have done in the past.

Source: Elon Musk, quoted by Tim Urban in “The Cook and the Chef: Musk’s Secret Sauce,” Wait But Why https://waitbutwhy.com/2015/11/the-cook-and-the-chef-musks-secret-sauce.html

A deeper investigation

Firstly, what is “financial literacy?”

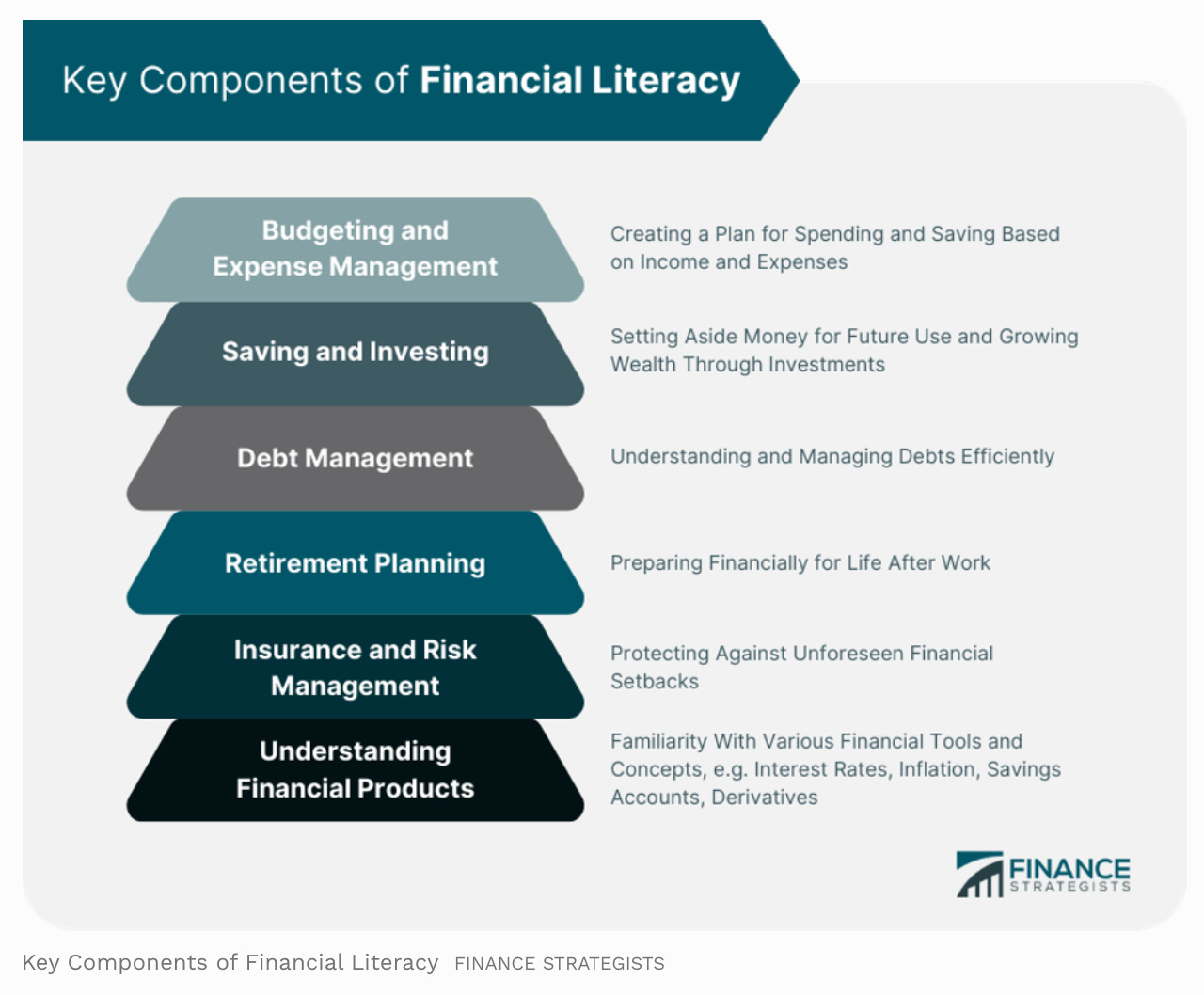

I like this infographic showing the components of financial literacy, which is to say that being financially literate is to be able to do the following tasks:

So, now that we have a definition, let’s come back to our original question: how big a problem is financial illiteracy on an individual’s life?

I like to try and answer questions by coming at it from different angles, which I refer to as lenses. How many lenses I apply depends on the level of confidence I have in coming to an accurate conclusion from what I’ve uncovered so far. In this case, it only took two.

Lens 1: Maslow’s hierarchy of needs

This is a great model depicting human needs (background info here).

When I go through these needs, it’s obvious that the needs within the two bottom/foundational layers require money…

CONCLUSION: It’s safe to draw the conclusion that financial literacy is a very important enabler of the basic needs (physiological & safety needs) of every human.

Lens 2: What does the research say?

I time-limited myself for how long I’d spend looking into the published research out there. As such, I haven’t drawn from an exhaustive list of empirical research this time… but I feel that three reputable sources have given me directionally accurate information.

One report I really found useful was the Financial Wellbeing and General Life Satisfaction in Australia report by the University of Newcastle. It highlights that:

“66 per cent of Australians can be classed as financially literate”

“individuals with higher financial wellbeing experience significantly higher levels of general life satisfaction”

and so many more gems within the report.

Another report I found useful was an article entitled The case for financial literacy education by npr. Some key takeaways are:

"Only 43% of the respondents (in the US) are able to answer all of the questions correctly"

"The young display very low financial literacy, with only one-third being able to answer all three questions correctly. Half of Whites could correctly answer all three questions, versus only 26% of Blacks and 22% of Hispanics."

"On average, Americans spend seven hours per week dealing with personal finance issues, three of which are at work. People with low financial literacy spend double that amount”

Another US-centric study utilising 27,000 survey responses during 2021 from individuals from all US states, entitled Financial literacy and financial well-being: Evidence from the US paints a similar picture. Some key takeaways are:

“Our results show that financial literacy continues to be low in the US. In particular, people who are younger, female, less educated, and not employed have the lowest level of financial knowledge.”

“Results show that those over 65 knew more about inflation than younger age groups. This could be attributed to the fact that they lived through the inflationary periods in the 1970s and 1980s.”

“The responses to the Big Three financial literacy questions help predict people’s financial behaviors and well-being. Those who answered those questions correctly were much more likely to have planned for retirement, remained financially resilient, and managed their debt better. In addition, exposure to financial education in school or at the workplace was linked to an increased level of financial well-being.”

“Our results also show that Black Americans had the lowest financial literacy levels of all subgroups examined … In addition, women were consistently found to have lower financial literacy, even after controlling for age, education, and socioeconomic status.”

CONCLUSION: This is a big, global problem, with ramifications for peoples’ general life satisfaction, and hints of productivity losses at an economy-wide level.

Bringing it all together

I’m pretty confident (90%+) in the following:

financial illiteracy is a big, global problem

financial illiteracy can have drastic effects on the quality of an individual’s life

financial illiteracy disproportionately impacts females, younger people, less educated people, and people in ethnic minorities

there are a lot of well-intentioned solutions out there trying to solve this problem, but it appears that they are not working at scale (i.e. persistent high levels of financial illiteracy

I’m somewhat confident (70%) in the following:

financial illiteracy can cause productivity losses at an economy-wide level

I’m less confident (<50%) in the following:

overall, financial literacy leads to a more satisfactory life for an individual

Where to next?

I’m looking forward to further exploring this problem, and also possible solutions. I don’t yet know where this will lead me, but I’m definitely curious enough to keep going, and the following questions are top-of-mind:

what are the root causes of financial illiteracy?

does the general population even “see” the problem, and/or can the general population identify as financial illiterate/literate?

are people motivated to become financially literate?

what is the best way to improve financial literacy? (education? on-the-job training? etc)

what is the impact of both financial literacy and illiteracy on the broader economy?